The Federal Reserve’s discount window may sound intimidating, but it is actually an important resource for maintaining the smooth functioning of banks and supporting economic stability. Let me explain how it works and what limitations apply to banks that utilize it.

Contents

What is the Discount Window?

The discount window offered by the Federal Reserve can be thought of as a program that allows banks to borrow money to meet their short-term capital requirements. It serves as a means for banks to quickly replenish cash that’s urgently needed.

- Fed Discount Window: https://www.frbdiscountwindow.org/

Reasons why banks use this program

- To ensure liquidity: to enable banks to meet customers’ withdrawal and lending needs.

- Smooth flow of credit: helps banks continue to lend money to people and businesses to support economic activity.

- Responding to unforeseen circumstances: to help banks manage liquidity issues even during market instability.

Types of Credit Available

- Primary Credit: A basic lending program for banks in good financial standing.

- Secondary Credit: A program with slightly stricter terms offered to banks that do not meet the requirements of Primary Credit.

- Seasonal Credit: For smaller banks with seasonal funding needs.

Banks and similar financial

institutions wishing to use this service will be subject to a detailed financial health review.

Important Restrictions

- Redemption period of up to 90 days: banks may borrow from the discount window for up to 90 days.

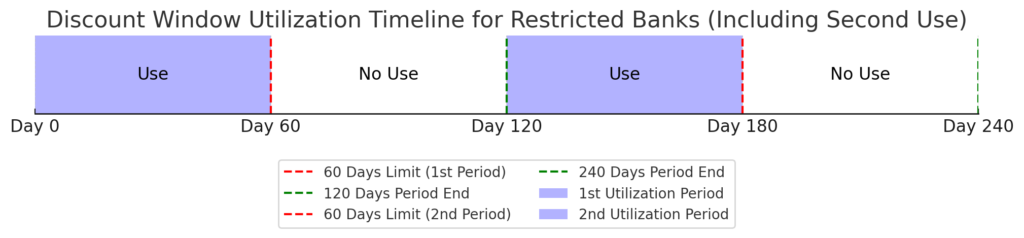

- 60-day limit every 120 days: Banks that do not meet capital standards can borrow for a maximum of only 60 days out of every 120 days.

- 5-day limit for near certainty of failure: Severely undercapitalized banks may only borrow for 5 days from the date of becoming so.

Deposit of collateral securities when obtaining loans

When obtaining a loan from the discount window, banks are required to deposit securities as collateral. This establishes a guarantee for the loan. The collateral must be securities that meet Fed regulations.

Discount Rate and Interest Payments

Borrowings from the discount window are subject to an interest rate called the discount rate. This rate is set by the FRB and varies depending on the terms of the loan. The bank receiving the loan is required to pay this interest.

Dividends on collateral securities on deposit

When collateral securities deposited by a bank in a loan at the discount window generate dividends or interest, the proceeds belong to the bank receiving the loan. This mechanism allows the bank to continue to enjoy the income generated by the securities even though they are provided as collateral.

Case Scenarios

In this section, we will provide some examples to illustrate how banks use the Discount Window.

Primary Credit Case Scenarios

Scenario Overview

Bank A decides to use primary credit to obtain a $10 million loan from the Fed’s discount window. In this case scenario, the interest rate of the primary credit is assumed to be 5.5%.

Loan Details

- Loan amount: $10 million

- Interest rate: 5.5%.

- Term: 90 days (3 months)

Interest Calculation

- Interest = Loan amount x Interest rate x (Term/365)

- Interest = 10,000,000 x 0.055 x (90/365)

- Interest = 134,794.52

- Total Payment = 10,000,000 + 134,794.52

- Total amount paid = 10,134,794.52

Bank A pays $10,134,794.52 to the FRB when the loan is redeemed.

Secondary Credit Case Scenario

Scenario Overview

Assume that Bank B receives a $10 million loan from the Fed’s discount window through a secondary credit facility. Assume that the interest rate on the secondary credit is 6.0% and that Bank B is in less than ideal financial condition, so it will be subject to lending restrictions for up to 60 days within the 120-day period.

Loan Details and Loan Restrictions Applied

- Loan amount: $10 million

- Interest rate: 6.0%.

- Duration: Up to 60 days (within the 120-day term)

Interest Calculation

- Interest = 10,000,000 x 0.06 x (60/365)

- Interest = 98,630.14

- Total amount paid = 10,000,000 + 98,630.14

- Total amount paid = 10,098,630.14

Bank B pays $10,098,630.14 to the FRB when the loan is redeemed.

If a bank using secondary credit borrows funds from the FRB over a specific loan period (e.g., 60 days), there is a 60-day limitation period after the loan is redeemed before the bank can next borrow again. This restriction is designed to prevent banks from becoming overly dependent on loans from the Fed through successive borrowings and a subsequent prohibition on lending for a certain period of time.

Therefore, their cash management and liquidity planning must account for this 60-day limitation period when banks access loans. The existence of such a restriction is an important component of the bank’s liquidity management strategy.

Case Scenario of a Bank Unable to Repay in Serious Financial Situation

Scenario Overview

Bank C is facing a dire financial situation and will receive an emergency loan from the Fed’s Discount Window. However, Bank C has only five days to obtain the loan, so it decides to take out a $10 million loan.

Details of the loan and application of loan restrictions

- Loan amount: $10 million

- Interest rate: 6.0%.

- Loan term: 5 days

Interest Calculation

- Interest = 10,000,000 x 0.06 x (5/365)

- Interest = 8,219.18

- Total amount payable = 10,000,000 + 8,219.18

- Total amount due = 10,008,219.18

Therefore, at the end of the loan term, Bank C should initially be required to repay $10,008,219.18. The collateral value provided by Bank C was $9 million, and the FRB can recover $9 million from this collateral. This means that a total of $14 million is available, including the $5 million in cash that Bank C was able to provide. Thus, there was enough to cover the loan amount, interest, and a surplus.

Disposal of Non-Payable Amounts

- Repayment and collateral execution: Bank C repays $5 million in cash and collects the remaining $508,219.18 (the $10 million loan amount plus $8,219.18 in interest minus $5 million) from the collateral.

- Treatment of surplus: If the collateral is valued at $9,000,000, and the amount recoverable exceeds the required repayment amount, the surplus is, in principle, returned to Bank C. In this scenario, Bank C can repay the FRB in full, and a surplus is recovered from the collateral after repayment.

- Further communication with the bank: If there is a surplus after processing the loan and collateral, the FRB and Bank C will discuss how to treat that surplus. This may include further steps to improve the bank’s financial condition.

As we are not in a position to examine the

inner workings of a failed bank for detailed processing processes, this should

be taken as a rough outline of the process.

Conclusion

We have found that the Fed’s discount window serves an important safety valve function for banks and contributes to overall economic stability. Understanding the terms and benefits of loans, such as interest payments and dividends on collateral securities, is also important for understanding financial market movements; the BTFP, which became available for only one year starting in March 2023, makes this more flexible. By understanding how the discount window works, you will also be able to see how the BTFP works.