Contents

Turn the end of the Fed’s monetary tightening into an investment opportunity.

Hi there, Cantom here.

We know when the Fed’s monetary policy shifts are one of the essential things for an investor. In this article, we will introduce a couple of analytical techniques that I found effective in identifying the turning point of monetary policy – in this article, we focus on the end of tightening. This is similar to a sailor reading the currents, providing clues as to the means necessary to reach one’s destination (profit).

Historically, the end of the tightening period provides the best opportunity to invest in U.S. Treasuries.

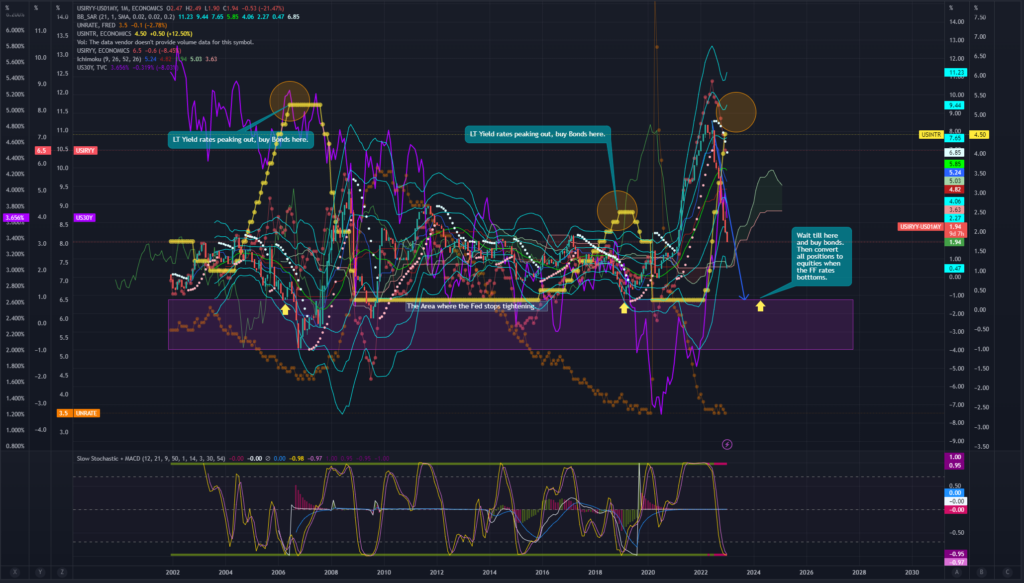

Cantom’s Technical Analysis

This method is my analysis method. Back-testing over the past 20 years has confirmed its high accuracy.

The method is quite simple and uses the following formula.

- (“U.S. Consumer Price Index (CPI) YoY”) – (“United States 1-Month Bond Yield”)

And if we can confirm that the number here is in negative territory, we will consider the Fed’s rate hike to be over.

Let’s confirm this using an actual chart.

For this reason, we need to pay close attention to the CPI figures in the current environment as of 2023.

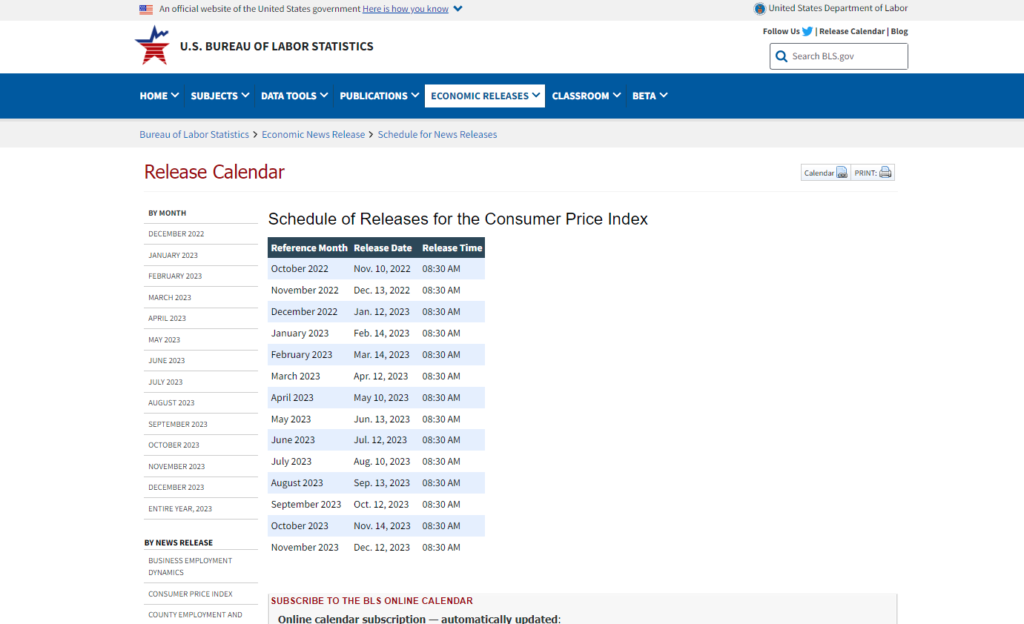

The U.S. BUREAU OF LABOR STATISTICS, which releases the CPI, has published a schedule for the year. It is worth taking a look at.

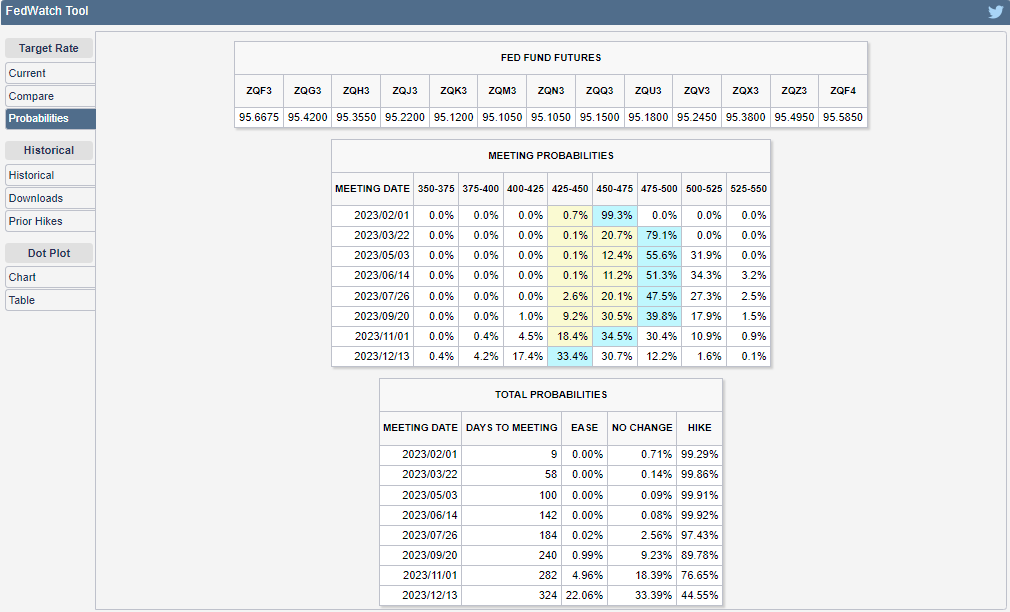

CME Fedwatch

You may be familiar with this very famous tool. You can get an idea of the consensus among market participants by going to the CME Fedwatch page and clicking on the Probabilities tab to see a schedule of expected changes in the F.F. rate. These estimates and probabilities change daily. You may want to be careful as it is merely market expectations.

How do you apply it to actual trading?

Since the investor’s response will differ depending on whether it is long-term or short-term, we will discuss each case separately.

For long-term trades

For long-term trades, you may consider holding a bond bull ETF such as TLT following the end of the policy rate hike. Sometimes people ask what about foreign currency time deposits, considering that interest rates are high now. Still, all warranties must be converted to the original currency to reinvest; the cost of exchange fees and currency fluctuations seem too costly. I think, however, it is a solid option if you are a U.S. resident making a time deposit.

On the other hand, holding fixed-income securities for an extended period has the advantage of receiving interest while aiming for a marginal gain and being able to reinvest the fixed U.S. dollars in stocks and other investments.

For these reasons, we think it is not easy to recommend foreign currency time deposits, which are not very profitable. (Normally, the value of a currency declines when bonds are rising.)

In the U.S., people are sometimes concerned about the sharp rise in CDS due to the debt ceiling problem. Still, in FY2022, the announcement of the fiscal policy in the U.K. caused market turmoil and a sell-off of treasuries, which the central bank and the government quickly extinguished. We are not worried about default as the U.S. is “Too big to fail.” (In fact, October was the best buying month for U.K. bonds.)

For short-term trades

We would use technical analysis and watch CPI and other economic indicators to determine our response. For example, if CPI exceeds market expectations, we expect inflation expectations to rise, and a reaction such as “higher interest rates = lower bond prices” would be expected. Technical analysis is an excellent way to respond, but it is also a good idea to look at the economic calendar to understand event risk.

U.S. Economic Calendar by Market Watch is lovely on your bookmark list.

I hope you find this helpful article.