The Appeal of Stable Investments

The world of investing is vast, offering a myriad of options. However, in times of high economic uncertainty, such as now, stable investments become particularly appealing. Today, we suggest the BIL (SPDR Bloomberg Barclays 1-3 Month T-Bill ETF) as an investment option that combines stability and accessibility for beginner to intermediate investors.

Investment Proposal: Introduction to BIL

BIL is an ETF that invests in short-term U.S. Treasury bills. These government bonds mature in a short period of 1 to 3 months. BIL aims to track the performance of these short-term Treasury bills.

Reasons for Selection

- Stability: Since the U.S. government issues it, there’s a very low risk of default.

- Liquidity: As an ETF, it can be easily bought and sold in the market.

- Low Risk: The short maturity period makes it less susceptible to price fluctuations due to interest rate changes.

Website Link for the ETF

Details on BIL

BIL offers specialized investment in the short-term Treasury market. It is suitable for investors prioritizing safety or seeking short-term cash placement options.

Industry Positioning

BIL has established itself as a safe investment option in the financial industry. Short-term Treasuries experience less fluctuation compared to stocks or long-term bonds and are considered a refuge during periods of market uncertainty.

Financial Condition and Growth Potential

BIL’s financial health is directly tied to its assets in U.S. government bonds, considered among the safest assets worldwide. In terms of growth, BIL focuses on tracking market yields rather than expecting significant growth, emphasizing the preservation of assets.

Dividends or Capital Gains?

Investing in BIL mainly targets income through dividends. Short-term Treasuries rarely generate capital gains, with the primary return coming from the interest on these government bonds. These dividends are typically paid monthly, allowing for the potential of greater returns through reinvestment in a high-interest environment.

Past Performance

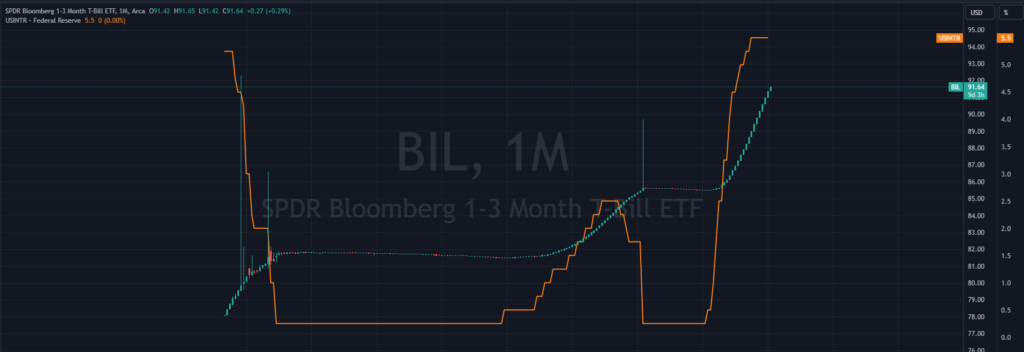

The short-term Treasury market has generally provided low but stable returns. In times of financial crisis or economic uncertainty, investment in short-term Treasuries increases, raising the value of ETFs like BIL. Since it reflects the monetary policy of the Federal Reserve, you can expect stable income with extremely low risk from BIL during monetary tightening cycles. See the following monthly chart of Bill.

Investment Calculator

This simulation is based on a scenario where the yield rate won’t change and you reinvest dividends.

Risks to Understand

The main risk for BIL is interest rate fluctuations. When interest rates rise, the value of existing low-yield bonds decreases. However, the short maturity of the Treasuries BIL invests in makes it less affected by interest rate changes, allowing for potential growth in investment through increased dividends due to rising interest rates.

In Conclusion

BIL is an ideal option for beginner to intermediate investors seeking stable investments. Its safety, liquidity, and low-risk profile provide a suitable investment method adaptable to macroeconomic conditions or economic cycles. Why not start investing in BIL today?