Don’t be fooled by interest rate differential traps.

Hello, Cantom here.

We have delved quite a bit into bonds in our interest rate series, and I would like to explain how to read the USD/JPY exchange rate, which is popular among Japanese investors. Generally, in macroeconomics, we are taught that higher interest rates make a currency stronger in value. Still, it is essential to note that exchange rate determination is a relative matter. And mastering bonds (especially medium-term bond interest rate differentials) will significantly help you improve your ability to analyze exchange rates.

Contents

The biggest mistake forex traders make

Many use leverage to hold a currency for swap points because of its high short-term interest rate. However, as a general rule, we recommend that you consider that currency exchange is not an investment product suitable for long-term holding. This is because of the following reasons.

- Swaps quickly lose their advantage due to short-term policy rate changes.

- When interest rates fall, the swap almost disappears, leaving only a capital loss.

- In many cases, when interest rate differentials contract, it is during a period of monetary easing, which makes it impossible to invest in stocks and other attractive instruments if you wait until your positions appreciate.

How to read the trend of USD/JPY

Regarding the USD/JPY pair, following the medium-term bond interest rate differential trend between the two countries is more precise. As mentioned in the previous articles of the Interest Rates series, government bonds are investment instruments whose direction can be manipulated by central banks through their monetary policy changes. In a nutshell, the golden rule for investors is “Don’t fight the Fed.”

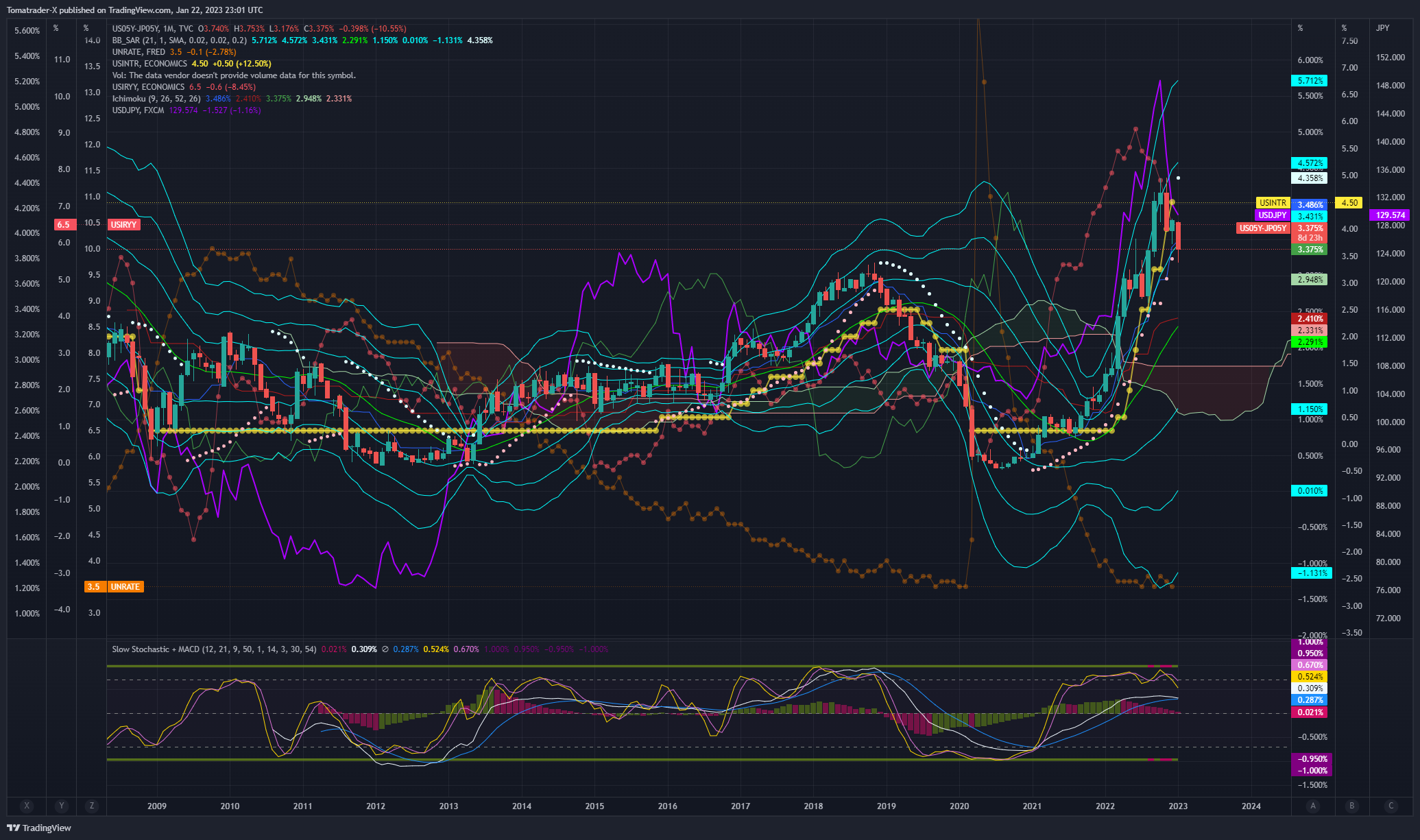

I will show you a chart created by subtracting the Japanese 5-year bond rate from the US 5-year bond rate, and the purple line is the USD/JPY rate, and you can see that it is following the trend nicely. In 2023, the US is expected to stop raising its policy rate. If we follow the pattern of bond prices bottoming out at the peak of the suspension of policy rate hikes, we can see the future direction of the dollar-yen rate.

You may also understand why Cantom is purchasing more bonds in 2023. If you are chasing swaps in FX, policy rates will fall, and you could be stuck in a capital loss without any income from swaps. If you were leveraged, you could lose all of your money.

How to work with Forex

While FX is a popular investment product in Japan, Cantom recognizes that it is a product for professionals. We think it would be better to trade within a relatively short time frame without being tempted by the swap points.

If you choose FX as an investment product, make sure to trade with a clear understanding of whether the interest rate differential between 5-year Treasury bills is in an expansionary phase or a contractionary phase.

- The Japanese Yen depreciates ( for USD/JPY) when the interest rate differential widens.

- The Japanese Yen appreciates when the interest rate differential is shrinking (for USD/JPY)

I hope you find this article helpful.